Why You Need an Insurance Representative for Comprehensive Protection

An insurance agent serves as a knowledgeable guide, assisting customers browse the details of different plans, evaluating risks particular to their requirements, and offering tailored insurance coverage services. The true worth of an insurance coverage representative extends beyond just policy referrals. The duty of an insurance policy agent goes far beyond mere policy sales; they act as advocates for their clients' thorough defense.

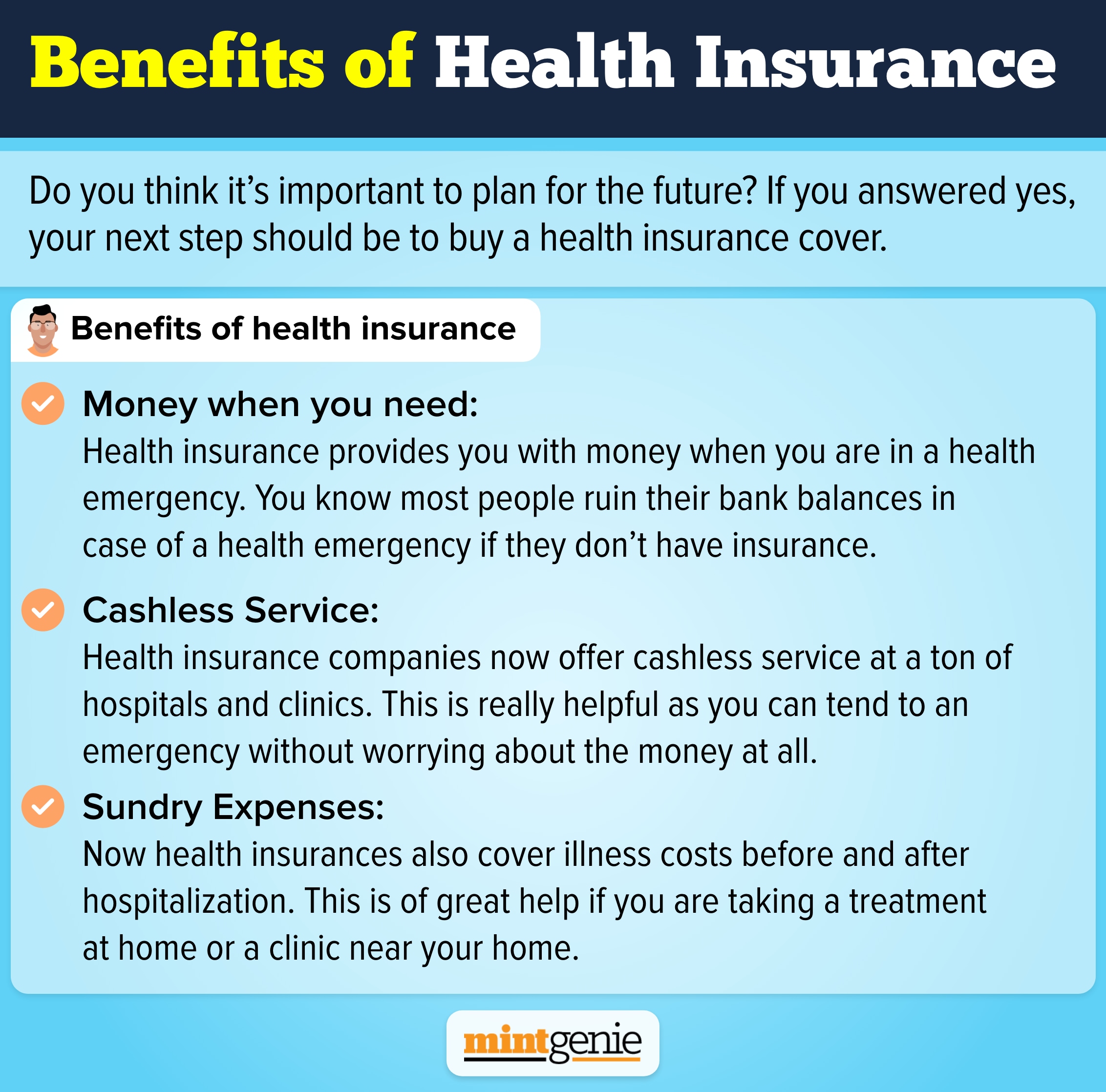

Know-how in Insurance Plan

With a deep understanding of different insurance policy plans, the insurance coverage representative excels in providing extensive insurance coverage tailored to satisfy each client's particular requirements. This proficiency is essential in navigating the complex landscape of insurance policy alternatives offered out there. The insurance agent's in-depth expertise enables them to examine dangers properly and advise the most appropriate policies to reduce those dangers properly. By staying current with the most recent market trends and governing adjustments, the agent can provide important insights to customers looking for insurance policy protection.

Customized Threat Analysis

The insurance representative performs a customized threat analysis to tailor insurance coverage options per individual customer's particular requirements. This analysis includes a detailed analysis of numerous factors such as the client's personal situations, possessions, responsibilities, and potential risks. By understanding the unique risk profile of the customer, the insurance coverage agent can recommend the most suitable coverage options to offer thorough defense.

During the tailored threat analysis, the insurance policy agent functions very closely with the client to gather relevant details and assess their current insurance policy coverage. This collaborative approach makes certain that the insurance policy remedies suggested are lined up with the client's goals and preferences. Additionally, the agent takes into consideration any type of possible spaces in coverage that need to be resolved to minimize dangers successfully.

Ultimately, the tailored risk analysis makes it possible for the insurance policy agent to use customized recommendations that satisfy the client's details demands and give assurance. Medicare agent in huntington. By customizing insurance policy remedies based on individual threat profiles, the agent can assist clients navigate uncertainties and secure their monetary wellness

Tailored Protection Solutions

Crafting bespoke insurance coverage packages that provide specifically per customer's distinct conditions and risk account is a trademark of the insurance policy representative's competence. By customizing coverage options, insurance representatives can make certain that clients are appropriately secured versus potential risks while staying clear of unneeded protection that may find out here now lead to greater premiums. This tailored approach enables agents to examine the individual requirements of each customer, thinking about elements such as their possessions, obligations, and future economic goals.

Customized insurance coverage remedies additionally allow insurance policy representatives to suggest the most suitable plans from a large variety of alternatives supplied by numerous insurance policy carriers. Eventually, working with an insurance policy representative to craft customized insurance packages makes certain that clients receive the most dig this reliable protection versus prospective risks.

Insurance Claims Support and Campaigning For

Aiding customers with navigating insurance coverage cases processes and advocating on their behalf is a crucial element of the insurance coverage representative's function - Medicare agent in huntington. When an insurance policy holder needs to sue, an insurance agent becomes their trusted ally, directing them via the often intricate and overwhelming procedure. Representatives possess the know-how to interpret policy language, assess protection, and ensure that customers receive fair therapy from the insurance provider

Additionally, insurance coverage representatives serve as advocates for their clients during insurance claim disagreements. In circumstances where there is argument between the insurance policy holder and the insurer concerning protection or negotiation quantities, the representative action in to represent the customer's best passions. This advocacy can be important in fixing problems and ensuring that clients receive the payment they are entitled to under their policy.

:max_bytes(150000):strip_icc()/88147259-569ff3dc5f9b58eba4ae1d57.jpg)

Continuous Assistance and Evaluation

By staying in touch with their customers, insurance policy agents can proactively identify brand-new risks or possibilities for prospective cost savings. Furthermore, insurance coverage representatives carry out regular policy examines to guarantee that the coverage in location aligns with the customer's current requirements and goals. Customers can count on their representatives to give individualized attention and expert guidance to adjust their insurance coverage as required, making sure extensive defense in an ever-changing globe.

Conclusion

To conclude, using an insurance representative offers know-how in insurance plan, individualized risk evaluation, customized insurance coverage services, claims click to find out more support, advocacy, recurring support, and testimonial. These professionals use thorough protection and help in browsing the complexities of insurance coverage. Their expertise and assistance can help people and businesses make notified choices to guard their properties and minimize threats properly.

:max_bytes(150000):strip_icc()/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)